25+ deduct mortgage interest

For taxpayers who use. Homeowners who bought houses before.

Home Mortgage Interest Deduction Calculator

Homeowners who are married but filing.

. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Web 2 days agoWhen it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Married taxpayers who file.

Web Standard deduction rates are as follows. It seemed a bit off as he was deducting. I have someone who does my taxes for me and he gave me the draft details to review before submitting.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web I know that on schedule E your deductions are limited to mortgage interest property taxes maintenance repairs utilities depreciation etc. Web Taxpayers who took out a mortgage after Dec.

Ad Easy Software To Help You Find All the Tax Deductions You Deserve. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. 13 1987 and before Dec.

To enter Form 1098-MA on Schedule A line 10. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. 12950 for tax year 2022.

Code Notes prev next a Allowance of credit 1 In general There shall be allowed as a credit against the tax. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web Use Form 1098-MA to calculate amounts for the 1040 Schedule A lines 10 or 11.

Im wondering if anyone can shed. Web They are certain outlays that you make throughout the course of the tax year and can deduct from your taxable income in order to lower the amount of tax you must pay. If you are married and filing separately then its limited to.

Web How a Mortgage Interest Deduction Works. From the Deductions section. Web If you got your mortgage after Oct.

The limit on deductions is shared between up to two personal residences. 16 2017 the limit is 1 million 500000 if you and a spouse are filing separately. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Go to Input Return. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage.

Web If your home was purchased before Dec. If you got a. Single taxpayers and married taxpayers who file separate returns.

Web You can only deduct mortgage interest on the first 750000 of your mortgage if you file single or married filing jointly. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Code 25 - Interest on certain home mortgages US. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web If youve closed on a mortgage on or after Jan. If you are single or married and.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web What is the mortgage interest tax deduction limit for a second home. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web deductible mortgage interest. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Mortgage Broker In Ontario Butler Mortgage

Image 025 Jpg

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

When Is It Advantageous For A Tax Filer To Take The State And Local Tax Salt Deduction When Will It End Up Being A Liability If We Take It Since We Pay Federal

First Time Home Buyer Guide Nc And Sc Edition

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Smith Manoeuvre Ed Rempel

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Taxable Income Formula Calculator Examples With Excel Template

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/8413723/Tax_Reform.png)

Donald Trump S Tax Plan In Fewer Than 500 Words Vox

Loan Vs Mortgage Top 7 Best Differences With Infographics

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Interest Deduction Calculator

Colten Mortgage Nmls 14210 Linkedin

The Complete Guide To House Buying In Canada Approvu

Ahit 497 Img026 Jpg

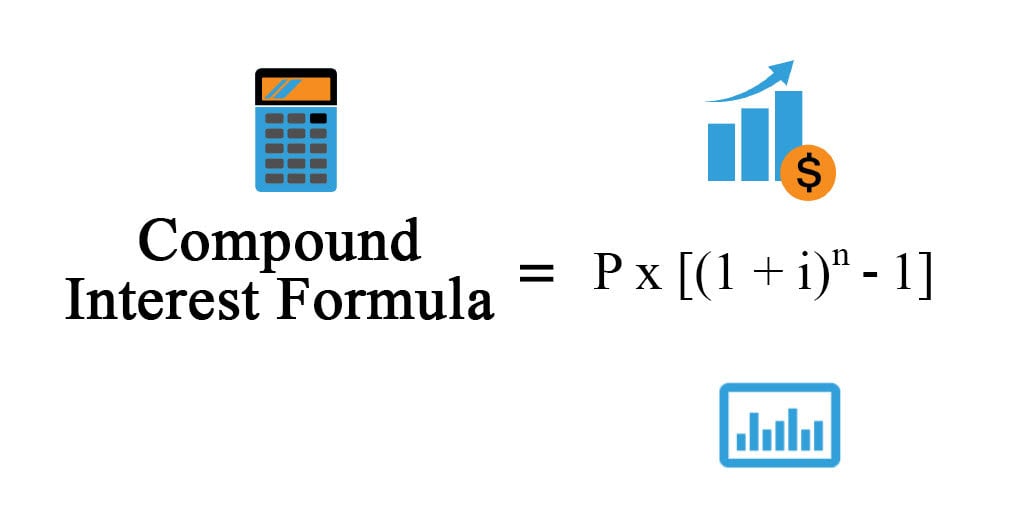

Compound Interest Formula Calculator Excel Template